Introducing the rekindled ally of the United States in the global economy

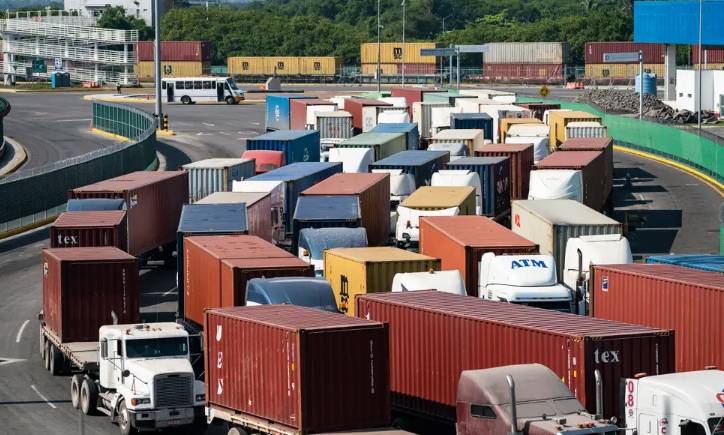

In a recent update by Luis Torres, a senior business economist at the Federal Reserve Bank of Dallas, it is evident that Mexico has reaffirmed its position as the foremost trading partner of the United States. The exchange of goods between the two nations during the initial four months of this year amounted to $263 billion. This trade with Mexico constituted 15.4% of the United States’ total imports and exports, slightly surpassing trade figures with Canada and China, which stood at 15.2% and 12%, respectively.

Even as the global community progresses beyond the peak of the pandemic, Mexico’s capacity to supersede China as the leading trading partner, despite China’s extensive integration into the US economy over the last two decades, serves as a distinct indication that the economic disruptions of 2020 are poised to cast a lasting influence on the world economy in the years ahead.

According to Torres, the groundwork for this transition was laid prior to the pandemic. Factors such as former President Donald Trump’s imposition of tariffs on select Chinese products and the ratification of the US-Canada-Mexico trade agreement, a modest revision of the nearly thirty-year-old NAFTA pact, contributed to this transformation. Yet, Torres also emphasized that these changes pointed towards a hastened move towards “nearshoring,” a strategy where nations relocate supply chains for essential goods to countries that share geographical and political proximity.

“Though current data on recent nearshoring is limited and substantiating evidence remains mostly anecdotal, the escalation of protectionist measures and the corresponding industrial policies align with reduced global trade, heightened regional trade, and the trends of nearshoring and reshoring (relocating production back to the home country),” Torres articulated in his statement.

Amid the pandemic, nearshoring witnessed a surge due to amplified expenses associated with shipping goods across the Pacific and the rising consumer expectation for swifter delivery, often referred to as “The Amazon Prime Effect.” Peter S. Goodman of The New York Times also highlighted earlier this year that enterprises like Walmart were progressively seeking local alternatives to fulfill their requirements, particularly as political tensions escalated between the United States and China.

“It’s not a matter of deglobalization,” remarked Michael Burns, a managing partner at Murray Hill Group, an investment firm specializing in supply chain matters, in conversation with Goodman. “Rather, it’s the subsequent phase of globalization with a concentrated emphasis on regional networks.”

Shannon O’Neil’s recent publication, “The Globalization Myth: Why Regions Matter,” puts forth the argument for prioritizing regionalization over globalization, contending that maintaining production in closer proximity would be advantageous for American workers. In his review of O’Neil’s book, Greg Rosalsky of NPR succinctly encapsulated the core perspective:

“According to O’Neil’s findings, the typical import from Mexico comprises ‘40% US made’ components, implying that 40% of the parts used in the final product originate from the US. Conversely, the average import from Canada contains 25% components produced in the US. On the other hand, for products arriving from China, a mere 4% of them have origins in the USA,” her analysis revealed.

Nevertheless, in recent times, President Joe Biden has endeavored to enhance the rapport between the United States and China, recognizing the widening divides that have emerged over the past few years, highlighted by incidents like the downing of a Chinese surveillance balloon in February. Secretary of State Antony Blinken engaged in discussions with China’s leader, Xi Jinping, in June, and Treasury Secretary Janet Yellen concluded a four-day visit to China more recently.

Blinken and Xi made a commitment to stabilize the ties between the US and China. Concurrently, Yellen expressed apprehensions regarding “unjust economic practices” while expressing optimism that the two nations could foster closer collaboration, noting that “the world offers ample room for both our countries to flourish.”

Amidst the perpetual shifts in the trade landscape, particularly involving China, one aspect remains evident at the moment: the trade relationship between Mexico and the US seems unwavering and poised for further expansion.